Catholic Foundation Board of Directors Announces Investment Management Enhancements

Catholics throughout northwest Pennsylvania are celebrating the significant growth of the Catholic Foundation in recent years. In addition to providing a myriad of fundraising resources extended to regional Catholic organizations, the Foundation has grown to manage over $25M in endowment assets. Reflecting this expansion, and as both fiduciaries and dedicated stewards of the Foundation, the board of directors is pleased to announce steps taken recently to take the board’s governance and oversight of the Foundation to a new level.

New Investment Partnership

During 2023 the Catholic Foundation assembled an ad hoc committee to conduct an evaluation of the Foundation’s current investment partners, as well as numerous additional firms. Their goal was to identify a best-in-class investment management partner specific to the Foundation’s need. As a result, Concord Advisory Group, based in Princeton, NJ, has been engaged to help steward growth and management of the Foundation’s financial assets going forward.

In business for over 37 years, Concord is a boutique, independent, investment consultant with significant expertise in advising Catholic and other non-profit organizations. In collaboration with the Catholic Foundation, exciting changes to the investment portfolio are underway that will focus on:

- Building an ‘institutional quality’ investment program with specialized access

- Integrated and dynamic alignment with Catholic responsible investment guidelines

- Sustainable process to deliver long-term growth and portfolio efficiency

- Expanding investment solutions to meet the needs of Catholic agencies in the community

Governance Expansion

An expanded Investment Committee comprised of lay Catholics with relevant professional expertise is in place. The committee actively supervises the Catholic Foundation investments through direct engagement with the investment managers in the faithful, moral, and responsible stewardship of funds.

Long-Term Portfolio Investment Policy

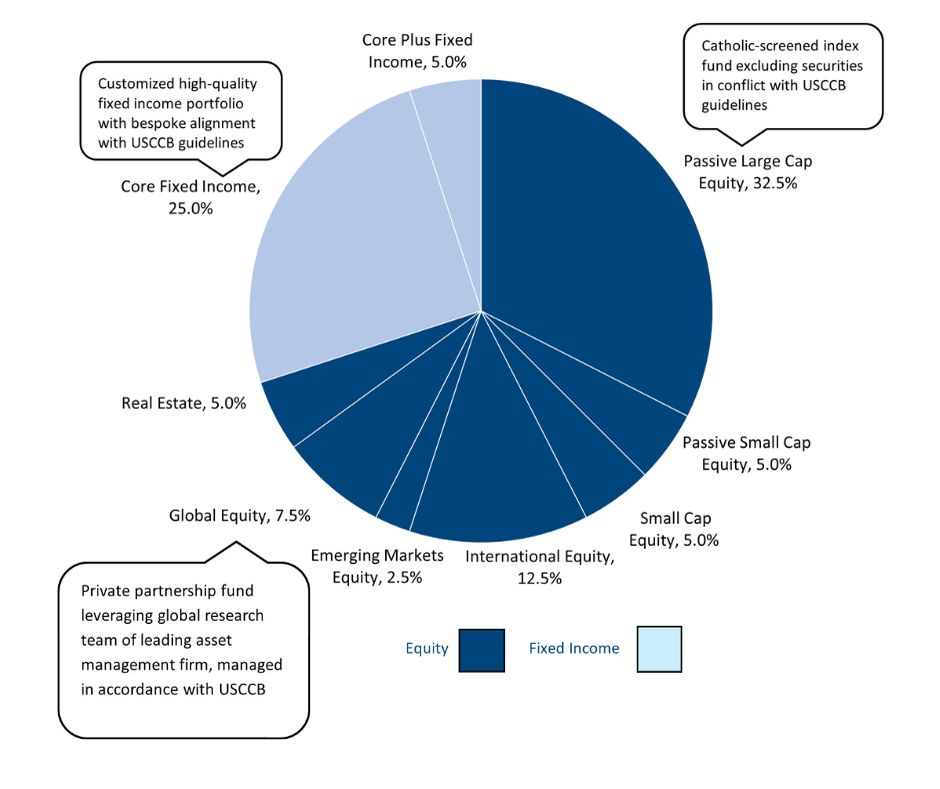

Return Objective: In keeping with the long-term strategy of the Catholic Foundation, the primary investment objective is the long-term growth of principal and generation of income sufficient to offset distributions and investment fees of the Foundation and to keep pace with inflation. The investment composition below reflects long-term asset allocation strategy developed by the Board, with assistance from the Investment Committee and Concord Advisory Group.

Integration with Catholic Values: Of primary emphasis within the Catholic Foundation investment portfolios is the full alignment with United States Conference of Catholic Bishops socially responsible investment guidelines. Each component and category have been carefully evaluated for its compatibility with these guidelines, and in most cases the Catholic Foundation utilizes access to specialized investment strategies to implement in a prudent manner across the portfolio. Several representative examples are included in the boxes below.